4 Ways A Little Paint Can Revitalize Your Home

Fixing up your home doesn’t have to be a budget-breaker. You can revitalize the look of your property with a little bit of paint in the right places.

Fixing up your home doesn’t have to be a budget-breaker. You can revitalize the look of your property with a little bit of paint in the right places.

Here are some areas that will really stand out to visitors or prospective home buyers.

1. Front Door

The front door always makes the first impression on visitors to your home. Remember that while they are waiting to enter your home, potential buyers have nothing to do except get a good look at your front door. For maximum impact, paint the front door a contrasting color to your house color. If budget allows, add a new door knocker and door knob.

2. Shutters

Vinyl shutters are very affordable when you buy them online. Before you hang them, use a spray paint gun to paint them in a matching color with your front door, or a contrasting color to your house color.

3. Interior Trim

If your home still has bare wood trim throughout, consider painting it. This will instantly modernize your home since exposed wood trim tends to date a house. The best trim color is actually a creamy shade – not white. White trim can come off as a little harsh, and your goal in most cases is to make your home look as warm as possible.

Based on the results after painting the trim, you may find that you don’t even need to worry about repainting the walls. Instead, just spot clean walls in areas where they most need it.

4. Statement Wall

Another way that a little paint can revitalize your home for sale is to paint just one wall in a room with a contrasting color. This is commonly called a “statement wall” because it helps define the room and make a big impact on guests.

Note that oil-based paint leaves a residual odor for quite some time. If your home is being listed soon, you’re probably better off using acrylic paint. Consult with your paint store representative for details.

These projects can all be accomplished by anyone who’s a little bit handy around the home. With a little paint and some elbow grease, your home will be picture perfect.

If you are interested in refinancing your home or accessing some of your equity for home improvement projects, contact your trusted home mortgage professional to discuss current financing options.

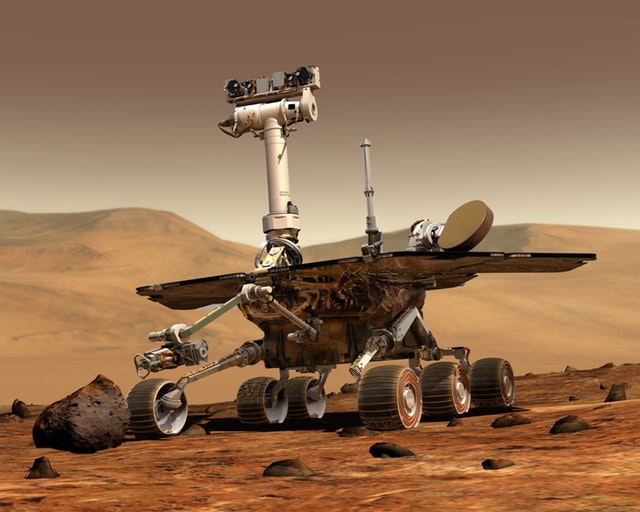

Real estate agents are constantly looking for new listings, which will attract potential buyers. We no longer need to limit our search for good listings to planet Earth because Mars is now for sale.

Real estate agents are constantly looking for new listings, which will attract potential buyers. We no longer need to limit our search for good listings to planet Earth because Mars is now for sale. Perhaps you plan to sell your home in the next few months or years. Keeping your garage organized can save time and ensure that you have storage space when you need it most.

Perhaps you plan to sell your home in the next few months or years. Keeping your garage organized can save time and ensure that you have storage space when you need it most.