Garage Organization Ideas For Your New Home

Now that you have a beautiful new home with a garage, the fun of organizing can begin. When your garage is well organized, everything is much easier. You can get home projects finished faster, get out the door quicker and better enjoy all your sporting activities.

Now that you have a beautiful new home with a garage, the fun of organizing can begin. When your garage is well organized, everything is much easier. You can get home projects finished faster, get out the door quicker and better enjoy all your sporting activities.

Here are some tips to organize your new garage.

Make Use Of The Walls

A lot of homeowners overlook the wall space when organizing the garage. If your garage has exposed studs, this is actually a benefit in terms of storage space. You can easily create shallow shelves in between the studs using 2 x 4 and shelf brackets. Use these shelves to store smaller items that tend to get lost on larger shelves. You can also create an effective space for hanging garden tools. Screw extra large hooks onto the outside edge of one of the 2 x 4s. Hang brooms, rakes and shovels from the hooks.

Utilize The Ceiling

You can also utilize the back area of the ceiling, beyond the area where the garage door stops when it’s raised. Install hanging systems that you can source from a local hardware store. You’ll be able to hang things like bicycles, skis, kayaks and more. Some homeowners even hang small lawnmowers and spreaders during off-season.

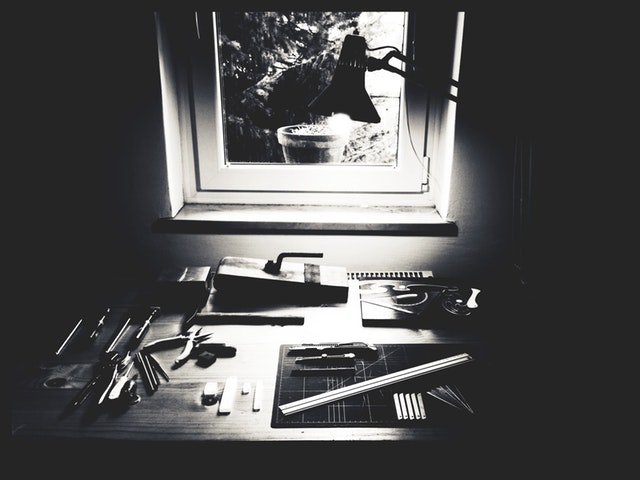

Invest In A Workbench

Even if you don’t do carpentry, a garage workbench is a useful part of an organized garage. This is the place where you can do small repairs on household items or add to your garage organizational systems. You’re more likely to repair an item when it’s sitting on your workbench and you have all the needed parts within reach. Install some smaller clear storage drawer units above the workbench to hold screws, nails and nuts and bolts in various sizes.

Hang A Pegboard

A pegboard provides a central place for your garage tools. Hang the pegboard on the wall within reach of your workbench. Outline the spaces on the pegboard for hammers and screwdrivers so they always get put back where they belong.

It’s never fun to have to endlessly search every time you need something from the garage. These garage organization ideas will make your new home and garage even more enjoyable.

If you are in the market for a new home or interested in refinancing your current property, be sure to contact your trusted home mortgage professional to find out about current financing options.

Bridge loans, which are also commonly referred to as interim financing, gap financing or swing loans, help a motivated home buyer to secure financing before their home or investment property sells. Lenders can usually modify these flexible loans to accommodate a person’s unique needs.

Bridge loans, which are also commonly referred to as interim financing, gap financing or swing loans, help a motivated home buyer to secure financing before their home or investment property sells. Lenders can usually modify these flexible loans to accommodate a person’s unique needs. If you have pet, you probably wonder what you can do to keep them safe after you decide to put your home up for sale. With all the disruption going on during a home sale, it’s all too easy for pets to get lost, frightened or even injured. Learn how to keep your beloved pets safe during your home sale.

If you have pet, you probably wonder what you can do to keep them safe after you decide to put your home up for sale. With all the disruption going on during a home sale, it’s all too easy for pets to get lost, frightened or even injured. Learn how to keep your beloved pets safe during your home sale.