Ways To Be Financially Prepared for an Emergency

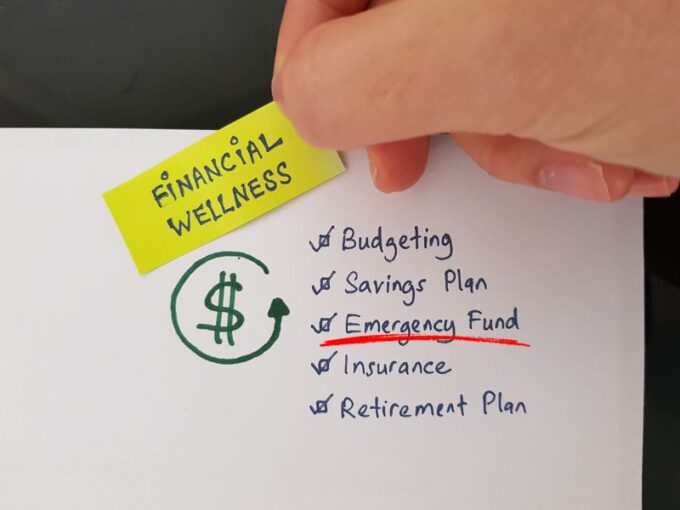

It’s important to be financially prepared for emergencies so that you can handle unexpected expenses or situations without having to worry about your financial stability. Here are some ways to financially prepare for emergencies:

It’s important to be financially prepared for emergencies so that you can handle unexpected expenses or situations without having to worry about your financial stability. Here are some ways to financially prepare for emergencies:

Build an emergency fund: Start by building an emergency fund that can cover at least 3-6 months of your living expenses. This fund should be kept in a separate savings account and should only be used for emergencies.

Create a budget: Create a budget and stick to it. This will help you identify areas where you can cut back on expenses and save more money.

Reduce debt: Try to pay off high-interest debts such as credit cards, personal loans, and other loans as quickly as possible. This will help reduce your financial burden and free up money for other expenses.

Get insurance: Make sure you have adequate insurance coverage for your health, car, home, and other assets. This will help protect you financially in case of any unforeseen circumstances.

Plan for retirement: It’s important to plan for your retirement as early as possible so that you can have a secure financial future. Consider investing in retirement accounts such as 401(k)s, IRAs, or other similar retirement plans.

Keep track of your finances: Make sure you keep track of your finances regularly by checking your bank accounts, credit card statements, and other financial accounts. This will help you identify any unusual activity and prevent fraud or identity theft.

Prepare a contingency plan: It’s a good idea to prepare a contingency plan for emergencies, such as job loss, medical emergencies, or natural disasters. This plan should include steps you can take to reduce expenses, sources of income, and other financial resources that can help you stay afloat during tough times.

How to Create an Emergency Budget

Creating an emergency budget can help you quickly adjust your finances during unexpected situations such as job loss, medical emergencies, or other unforeseen circumstances. Here are some steps to create an emergency budget:

Assess your current situation: Take a look at your current income, expenses, and debts. This will help you understand where you stand financially and what changes you may need to make.

Identify essential expenses: Make a list of your essential expenses such as rent/mortgage, utilities, groceries, and transportation. These are expenses that you cannot cut back on and will need to be prioritized in your budget.

Cut back on non-essential expenses: Identify non-essential expenses such as dining out, entertainment, and subscriptions that you can cut back on or eliminate completely. This will free up money that you can use for your essential expenses.

Prioritize debt payments: If you have debt, prioritize your debt payments and focus on paying off high-interest debt first. This will help reduce your overall debt burden and free up money for other expenses.

Consider additional income sources: Look for additional income sources such as freelance work or part-time jobs that can help supplement your income during tough times.

Monitor and adjust: Monitor your budget regularly and adjust as needed. This will help you stay on track and ensure that you are able to cover your essential expenses.

Remember, creating an emergency budget requires discipline and sacrifice, but it can help you weather tough times and avoid financial hardship.

Getting a mortgage can potentially help your credit score, as long as you make your payments on time and in full each month. Payment history is one of the most important factors that influence your credit score, so consistently making your mortgage payments on time can have a positive impact on your credit score over time.

Getting a mortgage can potentially help your credit score, as long as you make your payments on time and in full each month. Payment history is one of the most important factors that influence your credit score, so consistently making your mortgage payments on time can have a positive impact on your credit score over time. The holiday season is a time of joy and celebration, but it can also be a challenging time for your finances, especially if you’re juggling the responsibilities of a mortgage. However, with some thoughtful planning and budgeting, you can ensure that you enjoy the festivities without putting your financial stability at risk. I will provide you with essential tips and strategies to help you manage your mortgage budget during the holiday season.

The holiday season is a time of joy and celebration, but it can also be a challenging time for your finances, especially if you’re juggling the responsibilities of a mortgage. However, with some thoughtful planning and budgeting, you can ensure that you enjoy the festivities without putting your financial stability at risk. I will provide you with essential tips and strategies to help you manage your mortgage budget during the holiday season.