Challenges and Solutions for Mortgages in Remote Areas

Buying a home in a remote area can be a dream come true—peaceful surroundings, open spaces, and a slower pace of life. However, securing a mortgage for these properties comes with unique challenges. As a mortgage originator, I’m here to break down the hurdles and offer solutions so you can make your rural homeownership dreams a reality.

Buying a home in a remote area can be a dream come true—peaceful surroundings, open spaces, and a slower pace of life. However, securing a mortgage for these properties comes with unique challenges. As a mortgage originator, I’m here to break down the hurdles and offer solutions so you can make your rural homeownership dreams a reality.

Challenges of Securing a Mortgage in Remote Areas

- Limited Lender Availability

- Many traditional lenders hesitate to finance rural properties due to lower housing demand, unique appraisal difficulties, and the risk of market fluctuations.

- Higher Interest Rates & Stricter Requirements

- Lenders may charge higher interest rates or require a larger down payment to mitigate perceived risks in remote areas.

Appraisal Complexities

Since rural properties have fewer comparable sales (“comps”), appraisers may struggle to assess an accurate market value, potentially affecting loan approvals.

Property Restrictions

Some remote homes may be off-grid, lack traditional utilities, or sit on large plots of land—factors that can disqualify them from conventional loan programs.

Accessibility & Infrastructure Issues

Lenders consider road access, emergency services, and property maintenance when evaluating loans. If a home is too isolated or lacks year-round access, it may impact eligibility.

Solutions & Mortgage Options

- USDA Loans – A great option for eligible buyers in designated rural areas, offering 100 percent financing and low-interest rates.

- FHA Loans – While typically used in suburban and urban areas, FHA loans can work for remote properties as long as they meet HUD requirements.

- VA Loans – Eligible veterans can secure zero-down loans for rural properties, provided the home meets VA appraisal standards.

- Portfolio Loans – Some smaller banks and credit unions offer in-house lending solutions for unique rural properties.

- Construction Loans – If you’re building in a remote area, construction-to-permanent loans can finance both the land and the home.

- Seller Financing – In cases where traditional financing is challenging, negotiating directly with the seller may be an option.

While financing a home in a remote area comes with challenges, the right mortgage strategy can open doors to your dream home. Working with an experienced mortgage professional ensures you explore all available options and secure the best possible loan.

Thinking about purchasing in a remote area? Let’s connect and discuss the best mortgage solutions for your needs.

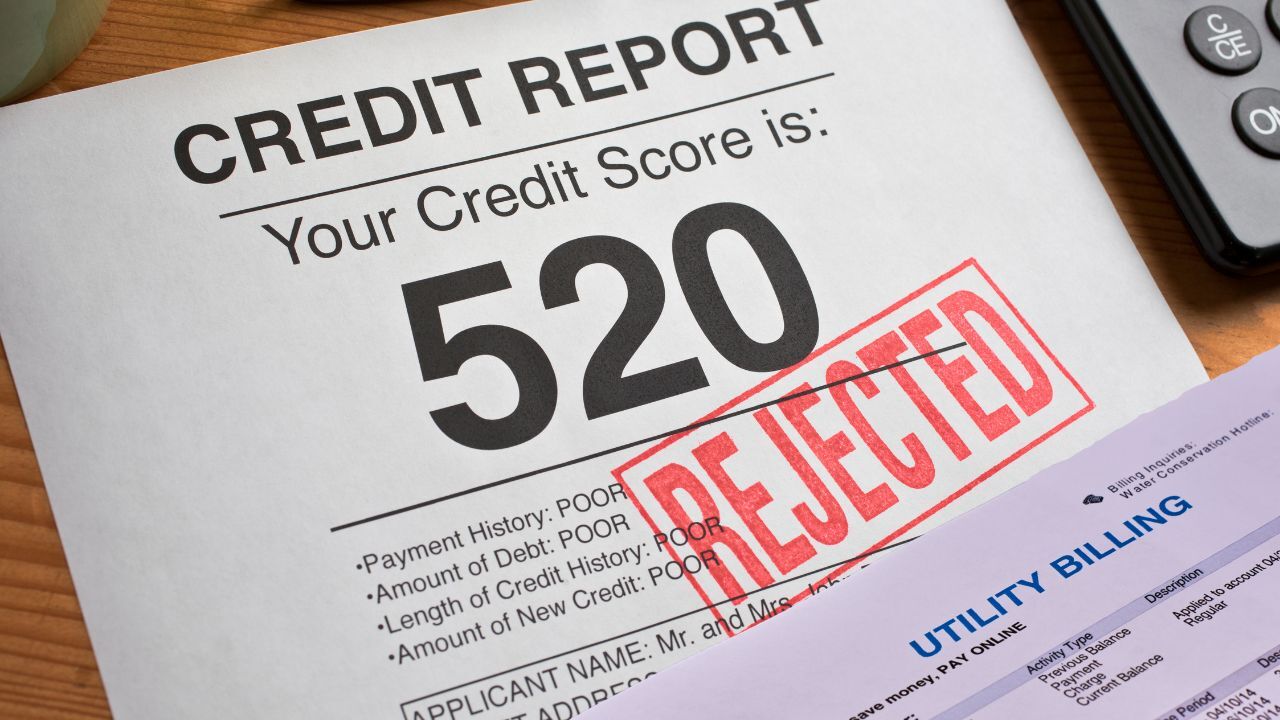

If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your creditworthiness, alternative credit history—like rent payments, utility bills, and other recurring expenses—can help you qualify for a mortgage.

If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your creditworthiness, alternative credit history—like rent payments, utility bills, and other recurring expenses—can help you qualify for a mortgage. Securing a mortgage as a self-employed professional can be more challenging than for traditional W-2 employees, but with the right preparation and documentation, it is entirely achievable. Here’s a guide to help you navigate the process:

Securing a mortgage as a self-employed professional can be more challenging than for traditional W-2 employees, but with the right preparation and documentation, it is entirely achievable. Here’s a guide to help you navigate the process: